Adding in a decrease in accounts receivable amounts.You will make some of these adjustments to net income when using the indirect method of cash flows. As such, one advantage of this method is that you don’t have to do an extra calculation to convert net income to the cash provided by operating activities, as you do with the direct method. The indirect cash flow accounting method starts with the company’s net income, which you then adjust in various ways to convert into cash flows from operating activities.īased on accrual accounting, this method incorporates non-operating expenses such as accounts payable and depreciation into the cash flow equation. $40 million – $30 million = $10 million.According to the formula, Rosie’s has $10 million in operational cash flow:

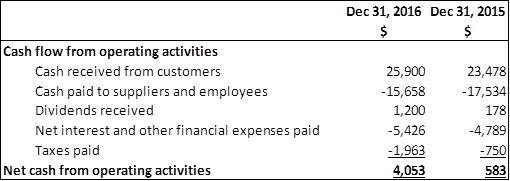

Say Rosie’s Rivets received $40 million from customers and dividends, and paid $30 million to suppliers, employees, and the bank (for interest). Since the calculation of cash-in-cash-out is straightforward, the direct accounting method uses the same simple formula as the net cash flow calculation, but applies it to the operating cash flows. The Financial Accounting Standards Board (FASB) requires those who use the direct method of cash flows to disclose this reconciliation. You don’t need to make any adjustments to translate the cash basis into operating cash flows, but you will need to manually reconcile net income to the cash provided by operating activities. This direct method of cash flow accounting is based on the cash method of accounting, so companies that use cash accounting will find it simplest to use the direct cash flow method. Your calculation might account for things like cash paid to the company by customers and dividends, and cash the company paid to employees and suppliers. The direct cash flow statement calculates cash flow using the actual cash amounts the company received and paid in the time period-known as the cash basis.

While there is a single way of accounting for financing and investing cash flows, there are two different options for operating cash flow accounting: Investing cash flow is money generated by a company’s investments, such as dividends from stocks or interest from bonds.Financing cash flow is money that a company garners from financing like loans, bonds, or selling new shares, which the company uses to finance its operations.Operating cash flow is cash from operating activities, which are the central activities of the business like selling products or providing services.Net cash flow encompasses three elements: operating cash flow, financing cash flow, and investing cash flow. Cash flow is movement of money in and out of your business, and net cash flow is the difference between the money that comes into a business and the money that flows out during a given period. Cash flow management is an essential element of business operations.

0 kommentar(er)

0 kommentar(er)